The real cost of expanding isn’t money. It’s missteps.

Southeast Asia is a magnet for remote founders. The cost of talent is lower. The timezone works. And the opportunity to scale regionally, without bloated overhead makes it a compelling next move.

But the moment you get serious about setting up, complexity gets in the way. Business registration brings up more questions than answers. Requirements change depending on who you ask. And the process, which should take weeks, drags into months.

This is where many founders stall. Because they assume expansion requires a full legal team. Someone for SEC, someone for BIR, someone who knows what to do when a form needs an immediate notarization but the notary is on lunch break.

The reality is, you don’t need more people. You need a system. A clear, compliant, remote-friendly process built for business owners who value their time as much as their growth.

This guide will walk you through exactly how to expand into Southeast Asia, specifically the Philippines, without hiring a legal team. You’ll learn how to approach business registration in a way that’s lean, professional, and designed for the way modern businesses operate.

Why Southeast Asia Makes Strategic Sense and Where Most Get It Wrong

Founders aren’t moving to Southeast Asia by accident. The region offers real strategic advantages. From access to skilled talent and favourable tax structures to growing digital infrastructure and lower operational costs. For location-independent companies, it’s one of the few places where lifestyle and scale can coexist.

But for all its advantages, the path to setting up isn’t always clear. Many founders make two critical miscalculations:

First, they treat business registration as a side task. Something to figure out after product, sales, or hiring. This delay compounds risk. Without a legal entity, you can’t open local bank accounts, issue proper receipts, or comply with regulations that matter to your clients and team.

Second, they assume it’s either too expensive or too complex to get it done properly. So they go one of two routes: DIY through outdated government websites, or hire someone cheap and unverified from a forum or group chat. Both approaches usually end the same way, stalled progress, sunk costs, and more questions than when they started.

None of this is necessary. If done right, business registration doesn’t need to be difficult. It just needs to be handled by a system that understands the local terrain and works the way modern businesses do… digital, responsive, and transparent.

Breaking Down Business Registration in the Philippines

If you’re planning to operate in the Philippines, understanding how business registration works is essential. You will be building a credible foundation that lets you hire, issue invoices, and grow without second-guessing your compliance.

Here’s what you actually need to know.

To register a business in the Philippines as a foreign entrepreneur, you typically go through the Securities and Exchange Commission (SEC), the Bureau of Internal Revenue (BIR), and the Local Government Unit (LGU). Each step has specific forms, identification requirements, and sequencing rules, and missing one can send you back to square one.

For example, the SEC requires specific naming protocol, minimum capital requirements, and a properly notarised Articles of Incorporation. Once that’s done, you’ll need to secure a Barangay clearance and Mayor’s permit from your local city hall. The BIR, in turn, will only process your application once you’ve secured the right business address, which must be verifiable and properly zoned.

That’s where many founders trip up. They rent a virtual office that isn’t registered properly, or they use a home address that gets flagged during verification. Suddenly, what looked like a simple business registration turns into a regulatory standstill.

A better approach is to use a provider that offers both legal guidance and a verified address that passes every checkpoint. At vOffice’s business registration service, for instance, all locations are already zoned and pre-approved for SEC and BIR registration, which means less back-and-forth, and no nasty surprises at city hall.

Why You Don’t Need an Entire Legal Team

Hiring a full legal team sounds safe on paper. You assume they’ll handle everything. The paperwork, the submissions, the follow-ups. But for most founders, especially those running lean teams or operating remotely, this approach does more harm than good.

It slows down decision-making. It bloats your costs. And often, it overcomplicates what could’ve been a straightforward process.

Most of what a legal team does during business registration can be replaced by systems, if those systems are built well.

That’s why infrastructure matters more than headcount. When your provider has built-in coordination with local authorities, understands the sequencing of requirements, and operates with government-accredited addresses, you get the same result, incorporation and compliance, without micromanaging it.

For example, vOffice’s company incorporation packages include everything from SEC filing and BIR registration to physical address setup, legal document preparation, and access to a digital dashboard. You’re essentially paying to finish without babysitting the process.

This is about cutting the unnecessaries. You’re still compliant. You’re still legal. But instead of hiring a fixer for every form, you’re using an end-to-end system that’s been refined for remote operators.

Business registration shouldn’t require more team members. It should require less friction.

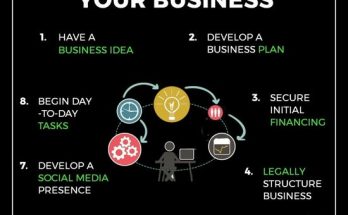

What a Streamlined 60-Day Business Registration Timeline Actually Looks Like

Most founders underestimate the power of a clear timeline especially when operating across borders. They either overprepare and stall for months, or rush through the process and get stuck fixing preventable errors.

A well-structured business registration process should take no more than 60 days in the Philippines. No redundant back-and-forth, and no wasted appointments.

Here’s what that timeline actually looks like when done right:

Week 1 to 2: Initial prep and compliance alignment

- Finalise your company name, business scope, and structure

- Submit basic requirements (passport, address, incorporation details)

- Choose a government-verified business address

- Get support on notarization and document formatting

Week 3 to 4: SEC Registration and Barangay/Municipal clearances

- File Articles of Incorporation with the SEC

- Secure Barangay Clearance and Mayor’s Permit

- Handle physical inspections (if required) through your address provider

Week 5 to 6: BIR Registration and operational setup

- Process BIR Certificate of Registration

- Register books of accounts and apply for official receipts

- Activate bank accounts, payment gateways, and payroll systems

- Final compliance review before launch

With vOffice’s end-to-end business registration service, this timeline is not theoretical, it’s been operational for a long time. Our clients receive a full progress tracker, email updates, and priority queuing through our established workflows with government agencies.

No daily follow-ups. No hiring multiple consultants. It’s a clear 60-day setup that lets you focus on building, and avoid navigating bureaucracy.

The less energy you spend figuring it out, the more you can spend showing up where it counts.

Final Thoughts: Expand Without the Overhead

Expansion doesn’t have to mean complexity. If you’re a founder building across borders, the goal is to stay focused on the parts of your business only you can lead and not to become an expert in local regulations.

Business registration is essential, but it doesn’t need to become a bottleneck. What matters is having the right support, the right address, and a process that understands how modern businesses actually operate.

At vOffice, we’ve helped over 28,000 businesses around the world register legally, operate compliantly, and scale without adding unnecessary overhead. Our virtual office solutions and company incorporation services are built specifically for founders who want professional infrastructure without the usual friction.

If you’re starting from scratch or expanding into the Philippines as your next move in Southeast Asia, the first step is making sure the foundation is handled.

It’s not the paperwork that moves your business forward. It’s what you do once it’s out of the way.

Frequently Asked Questions

1. How much does business registration cost in the Philippines?

The cost of business registration in the Philippines depends on the type of business entity and the services included. For example, registering a sole proprietorship through the DTI may cost as low as P2,030, while a foreign-owned corporation can exceed P150,000 due to additional legal and compliance requirements. End-to-end service providers like vOffice offer transparent, all-in pricing that covers government fees, notary services, legal filings, and address verification.

2. What are the requirements for BIR business registration?

To register a business with the Bureau of Internal Revenue (BIR), you’ll need several key documents, including your SEC Certificate or DTI Certificate, Barangay Clearance, Mayor’s Permit, and a valid lease contract or business address certificate. You’ll also need to apply for a TIN and pay the BIR registration fee. Working with a verified provider ensures all requirements are submitted in the correct sequence, preventing unnecessary delays.

3. Do I need a Mayor’s Permit and Business Permit to operate legally?

Yes. In the Philippines, the Mayor’s Permit and Business Permit is essentially the same for local compliance. These documents certify that your business is allowed to operate in a specific location and meets local safety, zoning, and tax regulations. For smooth processing, it’s important to use a government-accredited business address that’s zoned and approved for commercial use.

4. How long does it take to complete business registration in the Philippines?

With a reliable service provider, business registration in the Philippines can be completed in 30 to 60 days. Timelines vary depending on business type, ownership structure, and the speed of approvals from agencies like the SEC, BIR, and LGU. vOffice offers a clear registration roadmap that covers every step, from name reservation to full compliance, all while keeping you updated.

5. How do I check if my business is registered with BIR or DTI?

To verify BIR registration, you can check your Certificate of Registration (Form 2303) and confirm your TIN online. For DTI-registered businesses, visit the DTI Business Name Registration System (BNRS) and search by business name or reference code. If you’re using a virtual office provider, make sure their address is officially listed and recognised by local government units.